How to Check BVN

The Bank Verification Number, abbreviated as BVN, is a must-have for anyone seeking reliable financial services in Nigeria.

What exactly is BVN?

The BVN is similar to a security number, but it is used by banks and other financial institutions to identify an individual’s bank account details. It is a one-of-a-kind 11-digit number assigned to you upon biometric registration.

Biometric registration is the identification of an individual based on physiological characteristics such as fingerprints, voice, facial features, and so on.

On February 14, 2014, the Central Bank of Nigeria (CBN), in collaboration with all Nigerian banks, launched a centralized biometric identification system called the Bank Verification Number (BVN) to address the increasing compromise of customer security data such as passwords and PINs, as well as the challenges banks face with identity management.

The BVN has since been used to identify customers. However, many people have difficulty obtaining their BVN and gaining access to financial services because they forget or do not have them saved.

Fortunately, you do not need to go into the banking hall to obtain your BVN. You can check your BVN number on your phone from anywhere without jeopardizing your security. You can then save it for later use.

This function is available to all Nigerian telecom providers.

How to Check BVN on Glo, MTN, 9Mobile, and Airtel

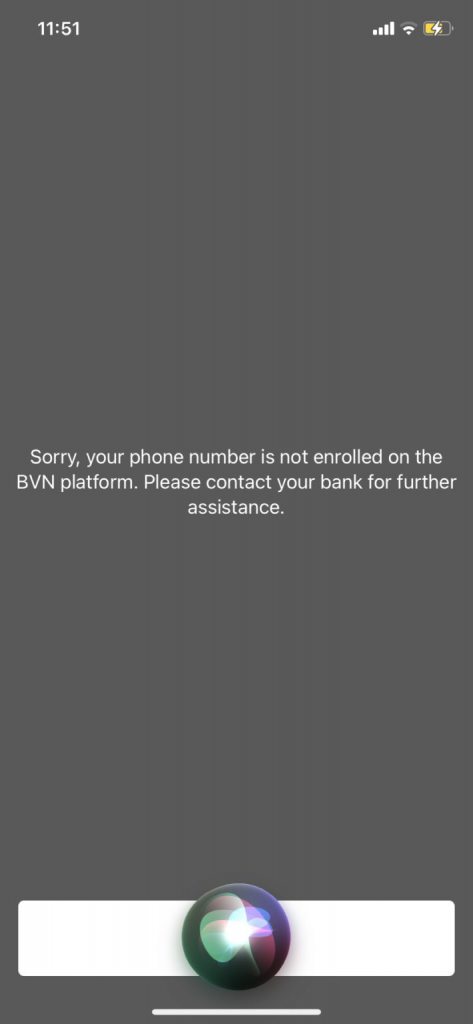

The first step before using this service is to ensure that the line you want to use is the one with which you registered the BVN. If you registered with MTN, you cannot check your BVN using an Airtel line.

After that is established, you can proceed to check your BVN by following these simple steps:

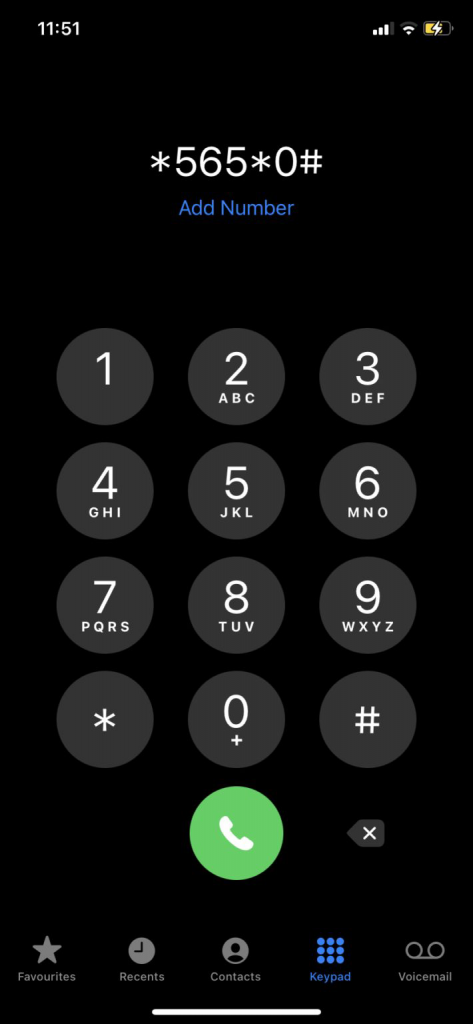

- Dial the USSD code 5650# from your phone dialer.

- Wait a few moments for the 11-digit number to appear.

- Take note of the number. You can either copy it and use it right away or save it for later. The service, however, is not free, and you will be charged 20 naira for the transaction. Saving for later use is therefore advised for those who cannot afford to tip telcos a total of $20 every time they check their BVN.

It is important to note that checking your BVN is not only the same process across all lines, but it is also similar across all banks. As a GTB or UBA customer, you use the same code to check your BVN because everyone is assigned one unique BVN that is used across all banks. This means that even if you have accounts with all of Nigeria’s banks, you’ll only have one BVN that connects them all to you.